Expert interview

Healthcare movers – the future of Baden-Württemberg's healthcare industry

The 'Healthcare Movers 2020 - Baden-Württemberg Report' reveals the potentials and challenges Baden-Württemberg healthcare companies encounter as the digital transformation of the healthcare market progresses. In an interview with Dr. Ariane Pott from BIOPRO, the authors of the report, Beatus Hofrichter and Dr. Ursula Kramer, explain what is required to take the major step towards becoming a digital avant-garde company.

Which companies do you classify as healthcare movers (HCM)?

Dr. Ursula Kramer is the author of the 'Healthcare Movers 2020 - Baden-Württemberg Report' and CEO of sanawork GmbH. © private

Dr. Ursula Kramer is the author of the 'Healthcare Movers 2020 - Baden-Württemberg Report' and CEO of sanawork GmbH. © privateDr. Ursula Kramer: Healthcare movers are companies in the healthcare sector that drive forward digital competitiveness in Germany and internationally. In other words, healthcare movers are companies that understand better than others how to use data and also how to access data from the different care areas. They use these data to develop competitive business models, and this is where their strength in the competitive environment lies. It is a very small group of companies that is driving forward the healthcare sector in Baden-Württemberg and Germany.

Beatus Hofrichter: We are looking at companies that mainly bring digital solutions to the market, i.e. we are not looking at pure implant manufacturers without any digital connection to the care process and that only place their product in their specific market niche. What we are looking at is business models that go beyond the familiar approaches currently used in the market. Healthcare movers are trying to open up further market segments via data with partners, be it from insurance companies, hospitals, start-ups and ICT companies (information and communication technology). They are thus building more agile, patient-oriented business models.

So this is also about digital competitiveness?

Beatus Hofrichter is the author of the 'Healthcare Movers 2020 - Baden-Württemberg Report' and CEO of ConCeplus. © private

Beatus Hofrichter is the author of the 'Healthcare Movers 2020 - Baden-Württemberg Report' and CEO of ConCeplus. © privateDr. Ursula Kramer: Healthcare movers are able to understand processes better because they have access to more data along the entire supply chain. They use these data to identify so-called 'unmet needs', i.e. gaps in the care sector, and derive new, competitive service or product concepts from them.

Beatus Hofrichter: The interesting thing is that this is based on a shift in mindset, i.e. a different view of the market. Digitalisation has been around for a long time, it has always focused on the production and quality of devices, or supported the conduct of clinical trials. Today, those that influence the field of digitalisation come mainly from outside the healthcare industry, especially IT companies. And these IT companies think in consumer and market terms. The leading healthcare movers have adopted this thinking and tried to understand how they can get closer to the market with their products. That is the striking difference between these companies and traditional business models.

What issue did you focus on in your report?

Beatus Hofrichter: We asked how the digital transformation of products and markets is progressing in the companies. This must not be confused with the internal digitalisation of company processes, for example in research, production or logistics.

Dr. Ursula Kramer: When asked about digitalisation, most companies will say that they are well digitalised. They say this because they have access to the internet, use digital communication tools and cloud solutions in business processes. But all this concerns process digitalisation, which is equally important. However, the approach we are taking with the healthcare movers is to find out whether companies are looking at the external supply chains they serve in a data-driven way in order to pinpoint dissatisfaction and inefficiencies.

The Baden-Württemberg medtech sector is characterised by a great deal of innovation in the products themselves. But many of these companies do not understand how to track their products for effectiveness in the care process by linking them to data. An orthosis, for example, is first and foremost a physical medical device. But if you add a sensor to the orthosis and receive information on how often the orthosis is worn and how movement changes, for example, you can further optimise its functionality. For example, one could offer coaching for orthosis wearers by giving them exercises to do at home to support therapy progress. This is a broader view of products and care processes. And I believe that this is what makes the difference. Healthcare movers go one step further: from the product perspective to the care perspective.

What is driving digitalisation?

Beatus Hofrichter: An important driver of digitalisation is new, forward-looking technologies, which we call 'next level technologies' in the report. These include artificial intelligence (AI) and machine learning; quantum computing will be added in the future. And we found that local biotech, bioinformatics and pharmaceutical companies, for example, some of which have been involved in the development of COVID-19 vaccines, have acted very agilely. Using computer simulations that were previously impossible, these companies are able to do in a year what normally takes ten. Companies need to develop the ability to be agile both in the market and in development. Building these resources concurrently is very difficult, especially for SMEs. It creates increased competitive pressure. In our study, we wanted to determine how companies have positioned themselves and how they can continue to position themselves in order to retain a leading place among the competition in the long term.

How are the companies assigned to the individual categories - avant-garde, visionaries, challengers or niche players?

Beatus Hofrichter: We have divided the companies into two groups: companies that are not represented in the digital environment are called traditionalists. Those that are represented in the digital environment fall into one of the four market quadrants: the niche players do not particularly stand out for their competencies on the technology side and the business model side, as they are only beginning their journey into the digitalised world. The challengers are the next step up. They use their existing technologies and are working on upgrading them through digitalisation. The third group is the visionaries, who tend to come from the start-up scene or the biotech or pharmaceutical sectors. They are endeavouring to break new ground in the market with new business fields. However, they often lack a good connection to technology. The leading group comprises representatives of the avant-garde, because these companies bring technology and business models together and thus drive the market forward. We have seen that the avant-garde already uses between four and seven forward-looking business models. Avant-garde companies are often larger companies from the ICT sector, insurance companies or very innovative start-up companies and consortia, such as the Heidelberg-based company HiGHmed.

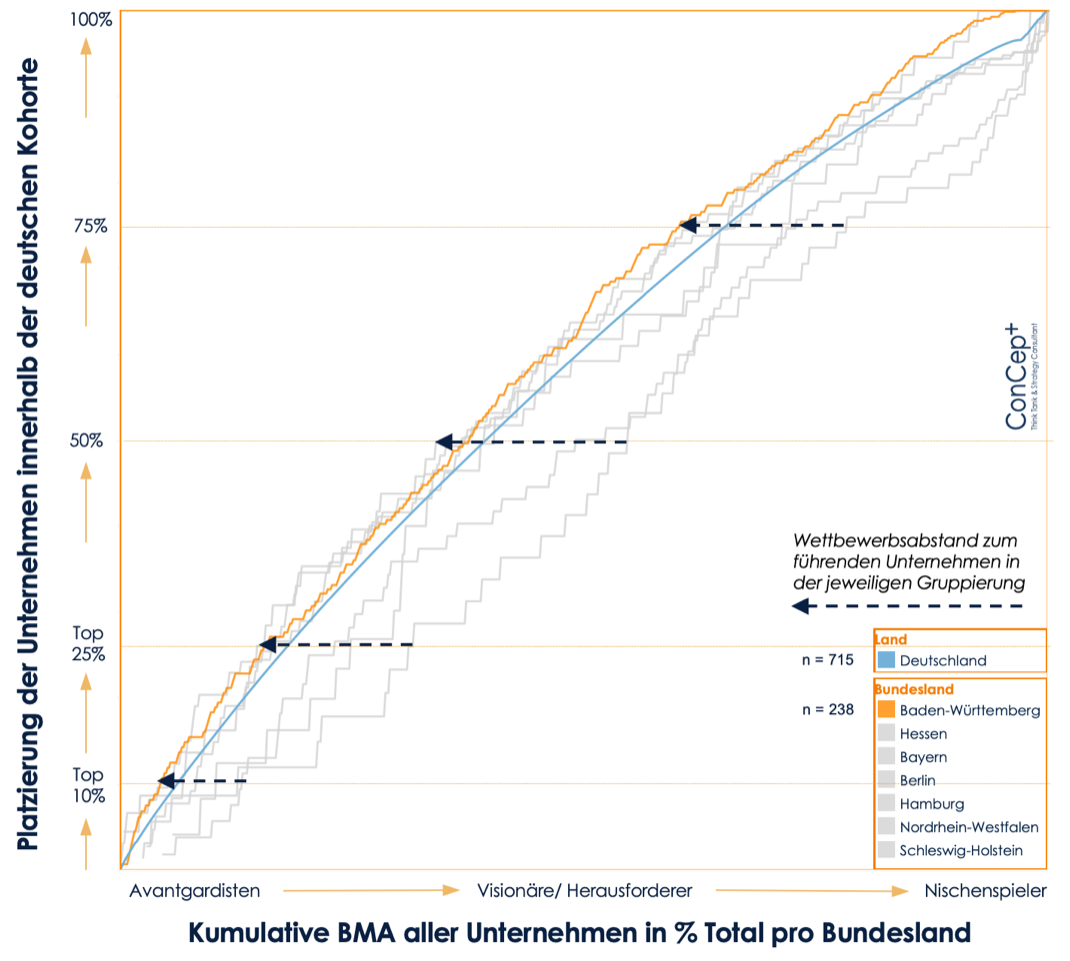

Dr. Ursula Kramer: The ability to use data is also expressed in the ability to develop new business models with the help of data, or to derive new insights from the data. And those who are good at this are way ahead on both axes of the chart presented by Mr. Hofrichter; they therefore belong to the avant-garde. In Baden-Württemberg, the avant-garde comprises a small group of 40 top companies - in Germany as a whole, 168 companies belong to this group. If we didn't have these companies, then the average would be dragged down significantly and Baden-Württemberg would not be a leader in Germany. There is a danger that the gap between this top group and the numerous traditionalists will widen. Companies will lose out if they fail to get on track and become players in the digitalised market environment.

Examples of the strategic positions of international healthcare movers from 2020. © BIOPRO Baden-Württemberg GmbH; Quelle: ConCeplus

Examples of the strategic positions of international healthcare movers from 2020. © BIOPRO Baden-Württemberg GmbH; Quelle: ConCeplus

How can companies venture the step into digitalisation? What advice do you have for the traditionalists?

Beatus Hofrichter: There are two ways of looking at this. I would not look at this so negatively. As far as the pure production of surgical instruments or other consumer goods is concerned, it is worth asking whether the production of such devices really needs to involve digitalisation or not. However, all other companies have to ask themselves how they can create a digital connection for their products on the market in the long term. This means that competences on the scale between product development and data integration must be established in the companies. And wherever possible, the companies must try to understand the market from the data side in order to get product feedback, as Dr. Kramer has just pointed out using an orthosis as an example. This creates a quality advantage. Integrating this kind of thinking into product development would be the biggest lever that could be used here.

Dr. Ursula Kramer: Companies need to go through a mindset shift, and move away from product thinking towards outcome thinking. The goal must be to improve healthcare outcomes and not just to optimise the product. And that is why this report is so important, too. Here, companies can reflect on which data they already have access to, and whether, and how, they can gain new data access and data use expertise through strategic cooperation. For this reason, we have highlighted in the report which companies from the integrated healthcare and ICT sectors are at the forefront of digitalisation and thus position themselves as interesting cooperation partners. One piece of advice I can give here is that companies should slightly expand their business into new markets and look beyond the boundaries of their own sector.

What conditions would have to be created in Germany and Baden-Württemberg for a better digitalisation environment?

Dr. Ursula Kramer: Interoperability and data standards play a very big role. And of course the question as to how a digital ecosystem can be designed on this basis. Here, it is particularly important that we harness our potentials at the European level.

Beatus Hofrichter: And data availability has to be merged for research and product development, and has to be made comparable and available to companies in Baden-Württemberg - respecting confidentiality agreements, of course. This will allow the avant-garde to advance existing developments, the other healthcare movers will also be pulled further up the ladder, and new companies from among the traditionalists will start to access the league of healthcare movers. This must be a long-term economic goal for Baden-Württemberg.